Augmented actuality headset maker Magic Leap has struggled with the legal guidelines of physics and did not get to market. Now it’s looking for an acquirer, however talks with Fb and medical items big Johnson & Johnson led nowhere in keeping with a brand new report from Bloomberg’s Ed Hammond.

After elevating over $2 billion and being valued between $6 billion and $eight billion again when it nonetheless had momentum, Hammond writes that “Magic Leap might fetch greater than $10 billion if it pursues a sale” in keeping with his sources. That value appears ridiculous. It’s the sort of quantity a prideful firm may strategically leak in hopes of drumming up acquisition curiosity, even at a cheaper price.

Startups have been getting their valuations chopped after they go public. The entire economic system is hurting resulting from coronavirus. Augmented Actuality appears much less attention-grabbing than digital actuality with folks avoiding public locations. Getting folks to strap used AR {hardware} to their face for demos looks like a troublesome promote for the forseeable future.

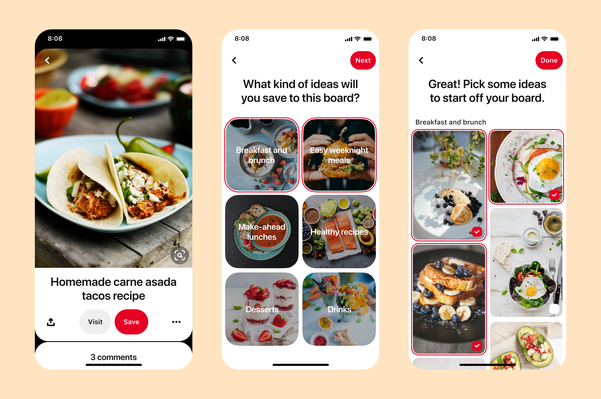

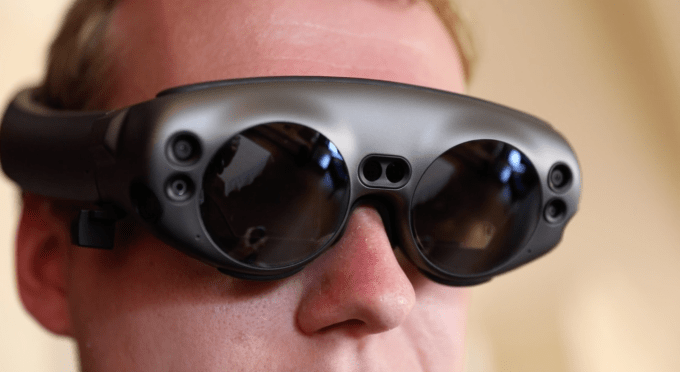

Nobody has confirmed a killer shopper use case for augmented actuality eyewear that warrants an costly and awkward-to-wear gadget. Our telephones can already ship loads of AR’s worth whereas letting you are taking selfies and do video chat that headsets can’t. My experiences with Magic Leap at Sundance Movie Pageant final yr had been laughably disappointing, with its clunky {hardware}, ghostly projections, and slim subject of view.

Apple and Facebook are throwing the enduring income of iPhones and the Information Feed into constructing a greater shopper headset. Snapchat has constructed middleman glasses since CEO Evan Spiegel thinks it will be a decade earlier than AR headsets see mainstream adoption. AR rivals like Microsoft have higher enterprise expertise, connections, and distribution. Enterprise AR startup Daqri crashed and burned.

Magic Leap’s CEO mentioned he needed to promote 1 million of its $2300 headset in its first yr, then projected it will promote 100,000 headsets, however solely moved 6,000 within the first six months, in keeping with a daming report from The Information’s Alex Heath. Alphabet CEO Sundar Pichai left Magic Leap’s board regardless of Google main a $514 million funding spherical for the startup in 2014. Business Insider’s Steven Tweedie and Kevin Webb revealed CFO Scott Henry and SVP of inventive technique John Gaeta bailed in November. The corporate suffered dozens of layoffs. It misplaced a $500 million contract to Microsoft final yr. The CEOs of Apple, Google, and Fb visited Magic Leap headquarters in 2016 to discover an acquisition deal, however no affords emerged.

Is AR eyewear a part of the long run? Virtually certainly. And is that this startup precious? Definitely considerably. However Magic Leap could show to be too little too early for a corporation burning money by the a whole bunch of thousands and thousands in a market newly fixated on effectivity. A $10 billion price ticket would require one of many world’s greatest companies to imagine Magic Leap has irreplicable expertise and expertise that may earn them a fortune within the considerably distant future.

The truth that Fb, which doesn’t shy from tall acquisition costs, didn’t wish to purchase Magic Leap is telling. This isn’t a product with a whole bunch of thousands and thousands of customers or fast-ramping income. It’s a bet on imaginative and prescient and timing that appears to be developing snake eyes. It’s unclear when the startup would ever be capable to ship on its renderings of flying whales and front room dinosaurs in a kind issue folks really wish to put on.

Considered one of Magic Leap’s early renderings of what it might supposedly do

With all their cash and loads of time earlier than widespread demand for AR headsets materializes, potential acquirers might doubtless rent away the expertise and make up the event time in cheaper methods than shopping for Magic Leap. If somebody acquires them for an excessive amount of, it seems like a write-off ready to occur.