Some Libra Association members like Andreessen Horowitz and Coinbase are double-dipping, backing a competing cryptocurrency developer platform. Launching right now with over 50 companions, non-profit The Celo Basis’s ‘Alliance For Prosperity’ provides a approach for builders to construct decentralized cellular apps which are primarily based on Celo’s blockchain platform and USD stablecoin.

The open-source Celo platform continues to be in testing with plans to formally launch its mainnet in April. The non-profit based in 2017 has raised $36.four million, together with its Collection A the place Andreessen Horowitz’s a16z Crypto purchased $15 million value of Celo Gold tokens.

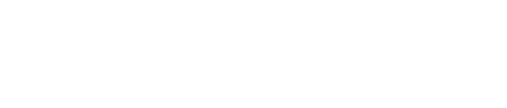

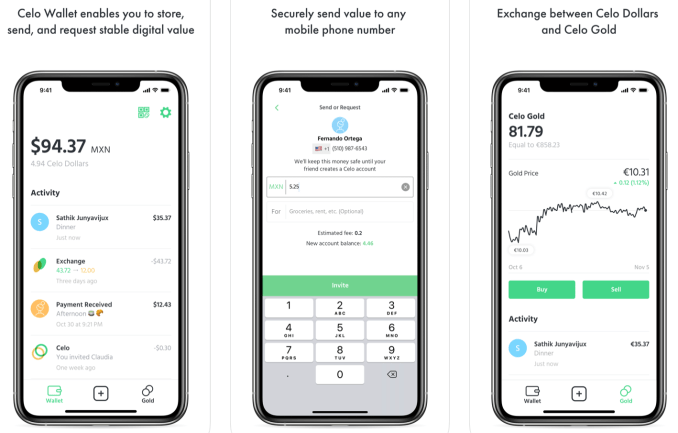

The largest differentiator of Celo’s community versus different blockchains is that funds within the Celo Greenback stablecoin may be despatched to folks’s cellphone numbers slightly than sophisticated addresses. The purpose is to make delivering utility by way of blockchain simpler by constructing a versatile community of functions that doesn’t scare regulators like Libra has.

The Alliance For Prosperity consists of Andreessen Horowitz (which funded Celo), Coinbase (Ventures), Bison Trails, Anchorage, and Mercy Corps — all of that are additionally Libra Affiliation members. That might doubtlessly create a battle of curiosity relating to which cryptocurrency and developer platform they promote to their portfolio firms, combine into their merchandise, or give attention to for delivering monetary companies to the needy.

Different high-profile Alliance companions embody Carbon, GiveDirectly, Grameen Basis, Maple, and Polychain. Companions have made a considerably obscure dedication to “backing growth efforts of the undertaking, constructing infrastructure, implementing desired use circumstances on the platform, integrating Celo belongings of their initiatives, or collaborating on training campaigns of their communities to additional advance the usage of blockchain expertise” based on Chuck Kimble, Celo’s cLabs head of enterprise growth and head of the Alliance. Anybody can apply to affix the open community, and there’s no minimal monetary funding like Libra’s $10 million prerequisite.

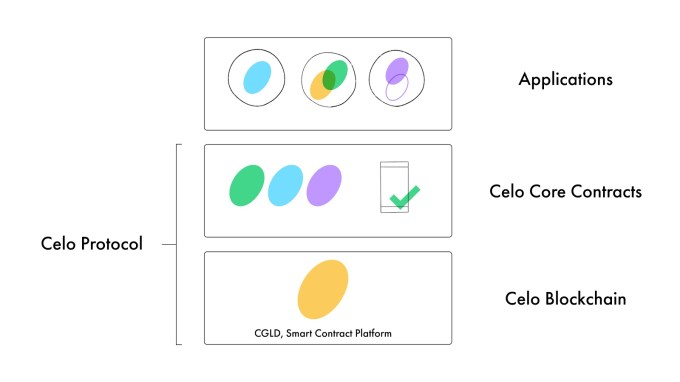

Celo isn’t making an attempt to exchange the greenback with its personal artificial forex, and its reserve is backed with different cryptocurrencies slightly than fiat money. That may make it extra acceptable to regulators who had been anxious that Libra’s token and fiat forex bundle-backed reserve might impression the worldwide monetary system. The primary of the decentralized apps on the platform, the Celo Pockets, is already obtainable for iOS and Android.

Like many blockchain initiatives, there are some lofty intentions for social impression with Celo. Use circumstances embody “powering cellular and on-line work, enabling quicker and reasonably priced remittances, decreasing the operational complexities of delivering humanitarian assist, facilitating funds, and enabling microlending” says Kimble. The true driver of this potential is Celo’s promise of a lot decrease transaction charges than conventional middlemen cost.

When requested what the most important threats to Celo’s success are, he informed me “Banking infrastructure enhancing quicker than we anticipate” and “Cellular adoption or LTE information not increasing on their present trajectory.” He didn’t point out the developer fatigue, regulatory scrutiny, technical complexity, or sluggish adoption of blockchain utilities which have plagued different crypto for good initiatives.

Right here’s the total record of members working in direction of these objectives:

Abra, Alice, AlphaWallet, Anchorage, Appen, Ayannah, Andreessen Horowitz, B12, BC4NB (Blockchain for the Subsequent Billion), BeamAndGo, Bidali, Bison Trails, Blockchain Academy Mexico, Blockchain.com, Blockchain for Humanity (b4h), Blockchain for Social Impression (BSIC), Blockdaemon, Carbon, cLabs, CloudWalk Inc, Cobru, Coinbase, Coinplug, Cryptio, Cryptobuyer, CryptoSavannah, eSolidar, Fintech4Good, Flexa, Gitcoin, GiveDirectly, Grameen Basis, GSMA, KeshoLabs, Laboratoria, Ledn, Maple, Mercy Corps, Metadium, Moon, MoonPay, Pipol, Pngme, Polychain, Venture Wren, SaldoMX, Semicolon Africa, The Giving Block, Utrust, Upright, Yellow Card, and 88i.

“Many of those organizations have on-the-ground operations that can start to get Celo into the palms of those that have been underserved by the present world monetary system” Andreessen Horowitz common associate Katie Haun informed me. “Our hope is that this partnership will begin unlocking the potential of web cash”. To spur adoption, the Alliance will distribute ‘Prosperity Items’ within the type of monetary grants to builders proposing Celo merchandise that may profit society.

There are additionally some peculiar traits of Celo’s system. Folks trade different cryptocurrencies for Celo Gold, then trade that for Celo {Dollars} they’ll spend. The reserve is backed with different cryptocurrencies like bitcoin and ethereum slightly that fiat, and isn’t totally collateralized. That might make it weak to a Celo financial institution run or crash in worth of these currencies. Celo additionally lets arbitrageurs pocket the distinction if Celo Gold and Celo {Dollars} get out of sync.

Whereas it may not be a hazard to the world monetary system like Libra, it could possibly be a hazard to itself. Not less than on the anti-money laundering entrance, cLabs — the staff that’s kicking off growth of the Celo platform — has employed former Capital One head of enterprise danger administration Jai Ramaswamy. Plus, the Celo founders come properly pedigreed, together with Marek Olszewski and Rene Reinsberg who spun out machine studying startup Locu from MIT and bought it to GoDaddy, in addition to EigenTrust inventor and former MIT Media Lab professor Sep Kamvar.

Whereas it may not be a hazard to the world monetary system like Libra, it could possibly be a hazard to itself. Not less than on the anti-money laundering entrance, cLabs — the staff that’s kicking off growth of the Celo platform — has employed former Capital One head of enterprise danger administration Jai Ramaswamy. Plus, the Celo founders come properly pedigreed, together with Marek Olszewski and Rene Reinsberg who spun out machine studying startup Locu from MIT and bought it to GoDaddy, in addition to EigenTrust inventor and former MIT Media Lab professor Sep Kamvar.

Thus far, 130 groups have expressed curiosity in constructing on the Celo platform. For reference, Libra stated 1,500 organizations had stated they wished to work on that undertaking 4 months after its reveal. Celo Camp and Blockchain for Social Impact Incubator can even be fostering initiatives for the blockchain.

Celo might make banking cheaper and extra accessible whereas energy new fintech innovation. However for any of that to occur, it might want to get sufficient builders constructing really helpful merchandise, make the blockchain and forex trade easy sufficient for mainstream audiences in growing nations, and develop adoption to significant ranges few cryptocurrency initiatives have but achieved. The Alliance For Prosperity should throw their weight into this undertaking, not simply their names, if it’s going to succeed.