Silicon Valley corporations had already been going remote-first when the coronavirus grew to become a worldwide pandemic. This implies there are many nice software program instruments already in the marketplace, which are seeing an enormous quantity of recent utilization now. And never simply Zoom. Alex Wilhelm checked in with HiveIO, Friday, FreeConferenceCall, Brandlive, Kentik, Bluescape, LogMeIn, and different remote-oriented SaaS startups giant and small to get the freshest information for Additional Crunch. Right here’s what FreeConferenceCall reported again, for instance:

- United States and United Kingdom: +6%

- India: round +10%

- France and South Korea: +20%

- United States of America: +170%

- China: +524%

- Hong Kong: +1576%

- Vietnam: +3836%

Subsequent, take a look at Ron Miller’s have a look at what specialists suggest proper now (EC) for those who’re making an attempt to make the transition on your workforce or firm.

We’ll have extra evaluation of nice remote-first corporations and funding areas developing quickly, because the working world goes by this abrupt transition to an already inevitable future. Within the meantime, you’ll want to take a look at our present protection:

Tips on how to work throughout a pandemic (TC)

How we scaled Seeq by being distant first (EC)

Tips on how to make distant work work (EC)

Important instruments for right now’s digital nomad (EC)

Distant staff and nomads symbolize the following tech hub (EC)

One last word: questioning why there’s no vaccine but? Connie Loizos caught up with long-time healthcare investor Camille Samuels for TechCrunch. “The rationale you hear about most cancers and orphan ailments a lot is that you may worth excessive in these areas,” the Venrock accomplice explains. “In therapeutic areas the place you’ll be able to’t worth excessive as a result of there are already a bunch of generics in the marketplace — ache, melancholy, different large unmet wants — you don’t see as a lot innovation. It’s a matter of [businesses] following the incentives. With infectious illness, you’ve bought this drawback that perhaps somebody even a yr in the past predicted may develop into an issue, however when it’s a possible and never an precise drawback, it’s arduous to get traders to fund one thing like that.”

Three cofounders is the magic workforce quantity for pre-seed traders

What are the primary traits of profitable pre-seed fundings today? Docsend, the doc administration firm that hundreds of founders use to share decks with traders, has a brand new report out that surveys current pre-seed fundings to find out what success is trying like today. Resident former VC Danny Crichton dug into the information — primarily based on an anonymized survey of founder-users — and highlighted some shocking traits on TechCrunch. Right here’s one: corporations with bigger founding groups have been capable of increase with fewer conferences, however the corporations that averaged the most important raises per variety of conferences have three cofounders.

CEO and TechCrunch/Additional Crunch columnist Russ Huddleston additionally mentioned that the standard bar for merchandise seem to have gone up. “We used to say you might get funding with an MVPP (minimal viable PowerPoint),” he mentioned, “however VCs are spending a major period of time trying on the product pages of profitable decks, and actually anticipate a stage of product readiness that we didn’t see 5 years in the past.”

A16z normal accomplice Connie Chan talks the way forward for shopper tech (together with remote-first bets)

With a current funding in digital conferencing startup Run the World, Connie Chan is on the forefront of shopper investing traits as we all know them right now. She sat down with Connie (Loizos) for a wide-ranging interview on Additional Crunch, listed here are just a few highlights:

- On D2C: “It’s much less particular virtually about what the product is, however the market they’re going after, and what sort of margins you must play with from a advertising and marketing standpoint.”

- On remote-first traits in China proper now: “Individuals are spending extra time at residence, so whether or not it’s video games or streaming or no matter they’re doing at house is doing effectively. A number of my counterparts in China are additionally taking all their pitches by way of video convention. They’re nonetheless doing work, however they’re all simply working from residence.”

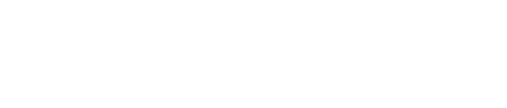

- On the potential for a ‘tremendous app’ like WeChat: “WeChat began as a communications platform, so naturally you’ll suppose communication is a superb place. However the different huge ingredient of a brilliant app is the funds layer, or some form of connection to both your bank card credentials or your checking account. So in that sense, anything that powers transactions additionally has a extremely good shot of doing it proper. Like, if I’m utilizing DoorDash to order meals, why not additionally use it to order X and Y and Z that additionally requires a bank card checkout or additionally requires some form of logistical supply. In the event you have a look at GoJek or Seize in Southeast Asia, that’s precisely what they’ve carried out. They began in transportation, however additionally they do grocery, they do meals, they do loans, they do fintech. They do the whole lot in a single place.”

TechCrunch Senior Editor Alex Wilhelm

Who’s Alex Wilhelm?

Alex is a long-time author, editor and analyst who totally rejoined TechCrunch not too long ago to put in writing prolifically on subjects together with however undoubtedly not restricted to a day by day finance column for Additional Crunch concerning the $100m ARR membership, unicorn IPOs, enterprise fashions, investing traits and different subjects which are most pricey to our startup viewers. He’s additionally the host of the favored Fairness podcast, an actual mensch, and like me, from Corvallis, Oregon. Given how in style he’s with our core readers, we determined to get him speaking about himself a bit extra on this Q&A on TechCrunch.

Throughout the week

TechCrunch

New AngelList information set sheds mild on the signaling dangers of seed-stage investments

SXSW cancels its 400Ok-person convention as a result of coronavirus

SF poised to go Prop E, which may considerably scale back new provide of startup workplace house

Startup Battlefield functions for TechCrunch Disrupt SF 2022 at the moment are open

Why you’ll be able to’t overlook the small particulars within the pursuit of innovation

Additional Crunch

Oyo layoffs, Airbnb’s delayed IPO and the long-term quandary of investing in journey startups

Understanding 2022’s early-stage fundraising market

Break-even advertisements can generate free model consciousness

Inside the hassle to show startups into zebras, not unicorns

Lerer Hippeau’s Ben Lerer shares his priorities for scouring seed offers

Expensive Sophie: I dwell in India and run a startup

#EquityPod

Right here’s what’s within the newest episode, by way of Alex:

- Kleiner has extra money, once more. A few yr after elevating a $600 million automobile, Kleiner Perkins raised a brand new, bigger fund. Now flush with $700 million, the longstanding enterprise group has extra money to play with than it has in current reminiscence. For early-stage offers, that’s.

- Atrium shut down after elevating $75 million. Buyers bought a few of their a refund, however the firm needed to lay off its 100 staff. The lesson right here is that well-known backers and tenured founders can’t will one thing into existence that doesn’t work.

- OYO is laying folks off. Once more. The key SoftBank Imaginative and prescient Fund-backed Indian lodge model was imagined to be a large hit. Now, with novel coronavirus and different challenges, it and world tourism are hitting snags.

- We additionally poked on the Robinhood downtime that got here throughout a interval of sharp buying and selling swings. The corporate has lots of work to do to get well person belief, and proceed to develop into its valuation. (Extra on that right here.)

- Zoom was the day’s excellent news, posting robust earnings (right here), probably indicating that remote-work corporations are seeing demand for his or her merchandise.

And don’t miss the Fairness Shot from this Tuesday, which Alex and Danny put collectively about activist fund Elliott Administration. It has simply purchased a big stake in Twitter and is making an attempt to take away founder and CEO Jack Dorsey(!).

Need Startups Weekly or any of the opposite nice newsletters from TechCrunch in your inbox? Subscribe right here.